Fixed Annuities

Get a retirement annuity with Protective Life

How do fixed annuities work?

If you want to guarantee retirement income while protecting your investment, a fixed annuity may be right for you.

- Money grows tax-deferred, similar to an IRA or 401(k).

- You can fund a fixed annuity in a single payment.

Fixed annuities work best if you can wait until age 59 ½ to withdraw* the money. Otherwise you’ll incur a 10 percent early withdrawal penalty, income tax and surrender charges - if those apply.

Common questions about fixed annuities

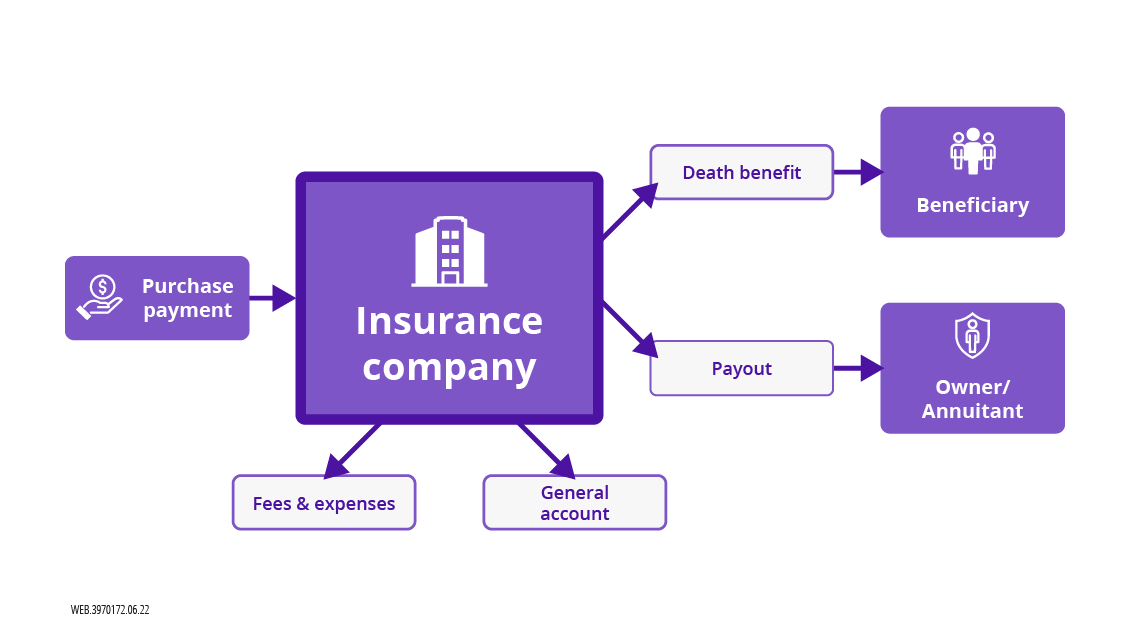

Fixed annuity contracts are between you and an insurance company. You agree to pay a single lump sum or make payments over time. In return, the insurance company agrees to credit your account with a fixed rate of interest and make a payment or series of payments to you at a later date.

Fixed indexed annuity earnings are solely based on a guaranteed interest rate. With a fixed indexed annuity, you have the ability to earn interest based on the performance of a specific market index.

Get a retirement annuity with Protective Life

The Learning Center can help you get smart about retirement annuity options

Neither Protective Life nor its representatives offer legal or tax advice. Purchasers should consult with their legal or tax advisor regarding their individual situations before making any tax-related decisions.

Annuities are long-term insurance contracts intended for retirement planning.