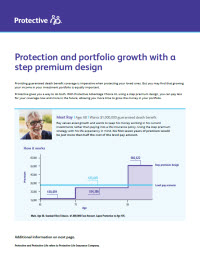

Some clients need more from their life insurance than just a death benefit. Protective Advantage Choice UL offers lifetime protection plus flexible features and potential cash value accumulation.

Why recommend Protective Advantage Choice UL?

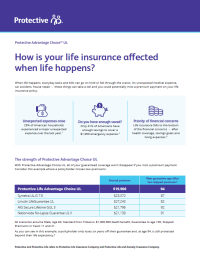

Your clients who want long-term protection with added flexibility can enjoy these 3 benefits:

Product snapshot

Get a quick profile of Protective Advantage Choice UL Universal life insurance and its flexible features.

Helpful resources on Protective Advantage Choice UL

We want to help you decide if Protective Advantage Choice UL is the right fit for your clients. Use these resources to learn more about this universal life insurance product and support your client conversations.

Other related topics

Protective Indexed Choice℠ UL for protection plus cash value

Protective%%®%% Lifetime Assurance UL for affordable guarantees

Protective%%®%% Strategic Objectives II VUL for strong accumulation

We're here for you

Everyone deserves peace of mind when it comes to safeguarding what’s most important. We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

1 All scenarios assume Male, Age 60, Standard Non-Tobacco, $1,000,000 death benefit, Guarantee to age 100, Skipped Premiums in Years 11 and 21.

WEB.3026589.01.23

WEB.3026589.01.23