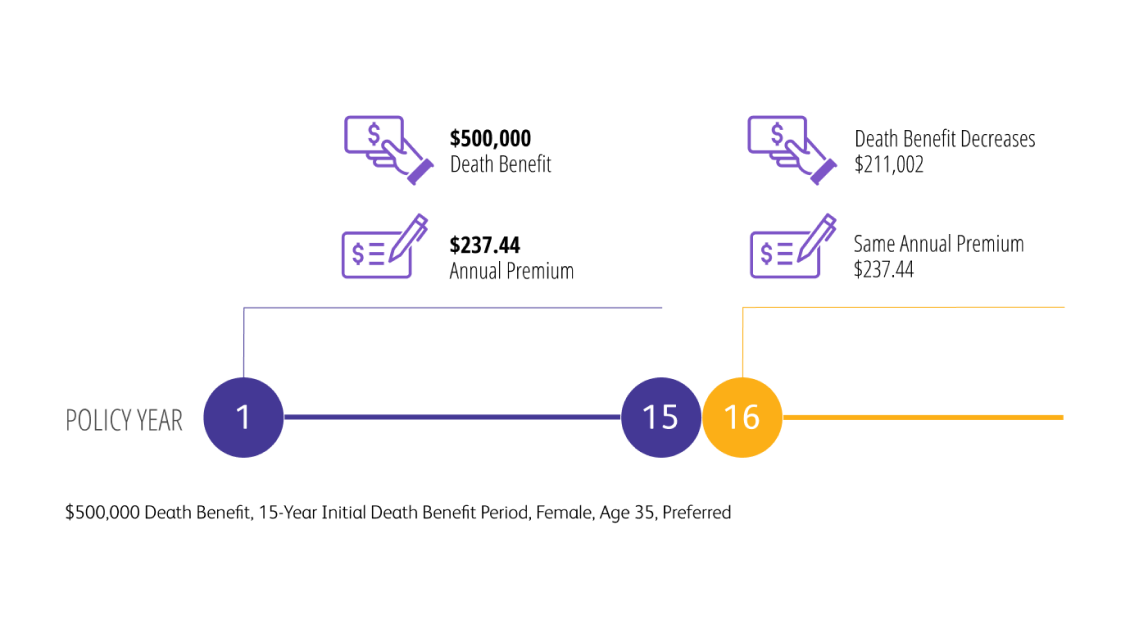

Offer clients protection for as long as they choose with premiums that stay the same even after the initial benefit period ends. The amount of universal life insurance coverage will decrease instead, likely in step with their changing needs.

Why recommend Protective Custom Choice UL?

Your clients who want affordable short-term universal life insurance coverage with flexible options can enjoy these 3 benefits:

Product snapshot

Get a quick profile of Protective Custom Choice UL and its flexible features.

Help clients choose the right short-term solution for their goals

In addition to Protective Custom Choice UL, we also offer a term life insurance solution to meet clients’ short-term protection needs. Share this comparison brochure with clients to help them choose the right fit.

Helpful resources on Protective Custom Choice UL

Use these resources to learn more about this short-term, universal life insurance product and support your client conversations.

Introduce clients to Protective Custom Choice UL

Show clients how they can still cover a mortgage after their level benefit period ends

Explain how a blended policy strategy can cover protection gaps

Other related topics

Maximize value and affordability with Protective%%®%% Classic Choice term

Everything you need to submit life business with us

Life Check Up to assess clients’ protection and changing needs

We're here for you

Everyone deserves peace of mind when it comes to safeguarding what’s most important. We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

WEB.3141719.01.23