According to the U.S. Department of Labor, fewer than half of Americans have calculated how much they need to save in order to have a comfortable retirement. That number can be a real eye-opener, especially when you consider that the average American spends 18 or more years in retirement, according to the U.S. Census Bureau. Many people are living longer into retirement than ever before. With an extra five or 10 years of retirement age to plan for, you need to think about how you'll save for those additional years.

A longer retirement can have a significant impact on your financial future. That's why it's important to take the time now, before you're retired, to get a better understanding of what you need to do to retire. Here's what you should know.

Retirement is lasting longer

According to the Social Security Administration, the average life expectancy for a 65-year-old American in 1940 was 14 additional years. Today, it's 20 years.

That means millions of baby boomer are spending more time in retirement than previous generations. Even if you are a younger millennial, knowing you could have a long-lasting retirement is something you need to consider and plan.

Here are some things you should think about when it comes to your retirement planning:

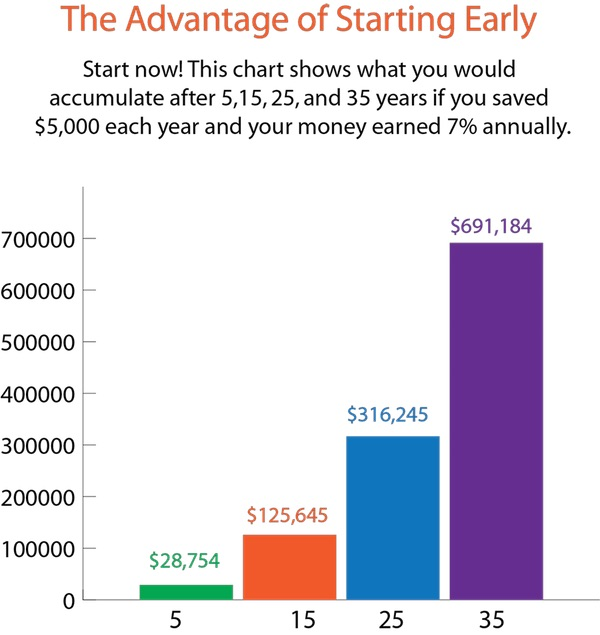

- The earlier you start saving, the better.

- Diversify your retirement savings to minimize risk. Adjust your retirement planning through your working years with the help of a qualified financial professional.

- If your company offers 401(k) matching, try to contribute enough from each paycheck to get the maximum amount.

- Consider opening a traditional or Roth IRA and making regular contributions.

- Don't count on Social Security to be your only source of income during retirement.

- Starting late is better than not starting at all.

- As healthcare advances help you live longer, plan now to save so you can live well in those extra years.

- Also, plan to save for healthcare costs not covered by Medicare.

- Set extra savings aside for possible inflation and increased taxes.

Data courtesy of U.S. Department of Labor

Using a budget to plan

When planning for retirement, it's important to set smart and realistic goals. Many retirees underestimate what expenses will be in retirement. '

The average monthly Social Security benefit received by retired American workers is only about $1,543.81 How much more will you need to live the way you want? One rule of thumb is that you may need 80% of what you make now in retirement, but unexpected things could sink your retirement ship if you don't plan ahead, such as rising health care costs, in-home and long-term care needs, declines in home equity, stock market turmoil and funeral costs.

By allocating enough money for expenses — both the expected and unexpected — you'll be better able to budget and plan for your future.

For many, creating a budget is a great way to start preparing for retirement. With a budget, you can track your income and expenses, and calculate what you can set aside every month for retirement.

Here's what you can start tracking:

- Fixed expenses — These are the bills you have every month, they can include your mortgage and car payment, utilities and property taxes.

- Variable expense — This is the money you spend that can change every month, including your grocery or vet bill, eating out at restaurants and shopping.

- Savings — Also keep track of what you can save, the money you can put into your IRA, use to pay off debts or add to your emergency fund.

Knowing what you're starting with, you can adjust your spending if you want to save more. Less eating out can help add more to your retirement account, for example.

Questions to ask yourself about your retirement plans

A big part of saving for retirement also depends on the type of retirement you plan to have.

Here are some questions to consider that can help you start estimating some of your lifestyle costs in retirement:

- Where you'll live — Think about your living situation. If you're planning on staying in your current home, consider downsizing to a smaller place or even moving to a 55-plus community.

- If you'll work — Some people prefer to fully retire while others might want to have a part-time job to stay active. Having some income coming in could potentially help add to your retirement savings.

- Your health — As you age, it's more likely you could end up needing more medical care. Consider your current health and decide if you need to start putting funds away for potential healthcare costs like getting disability or long-term care insurance.

- Your dependents — Many people will find themselves in a sandwich generation, caring for older children and aging parents at the same time. You might have to consider having funds set aside for this possibility.

Use a retirement withdrawal calculator to see how long your money will last

If you're looking at your savings and wondering how long it will last, try using a retirement withdrawal calculator. Here are a few of our top picks to help get you started:

- Money-Zine.com — By plugging in seven numerical fields, this basic retirement withdrawal calculator can give you an estimate of how much money you'll need based on your projected life expectancy. At the end, the calculator summarizes your results for an at-a-glance peek at what you may be looking at.

- Vertex42.com — This website offers a free Microsoft Excel Retirement Withdrawal Calculator that you can download and actually have a little bit of fun with. This calculator gives you a lot more flexibility and customization than most online calculators, and even allows you to print off a payout schedule.

- Bankrate.com — Because how much money you'll need in retirement depends on how long you'll live, we're tossing in Bankrate's life expectancy calculator. Based on your input, you'll have a figure that you can use as a general gauge when it comes to estimating your longevity.

Planning early matters

Retirement can be expensive. If you haven't started saving, then now's the time. Make a plan, set some goals and stick with them. It's never too early or too late to start saving.

Learn more about setting smart and realistic retirement goals.

1. http://www.ssa.gov/news/press/basicfact.html

WEB.1010422.09.18