Our indexed universal life insurance solution can protect your clients’ goals while offering flexibility to adapt to life’s changes – including the opportunity to grow and access cash value that’s linked to market index performance.

Why recommend Protective Indexed Choice UL?

With our indexed universal life insurance solution your clients who want both protection and flexibility can enjoy these four benefits:

An IUL that delivers what's expected

You can feel confident recommending our indexed universal life insurance solution because it’s built to perform as your clients expect. Read this flyer to see why.

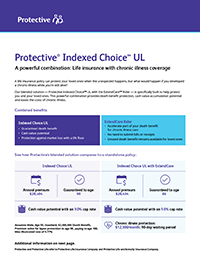

Product snapshot

Get a quick profile of Protective Indexed Choice UL and its combination of protection plus cash value potential.

See how we stack up against the competition

Enter your information below to see where Protective Indexed Choice UL stands compared to another popular solution.

Helpful resources on Protective Indexed Choice UL

We want to help you decide if this solution is the right fit for your clients. Use these resources to learn more about the product and support your client conversations.

Introduce clients to Protective Indexed Choice UL

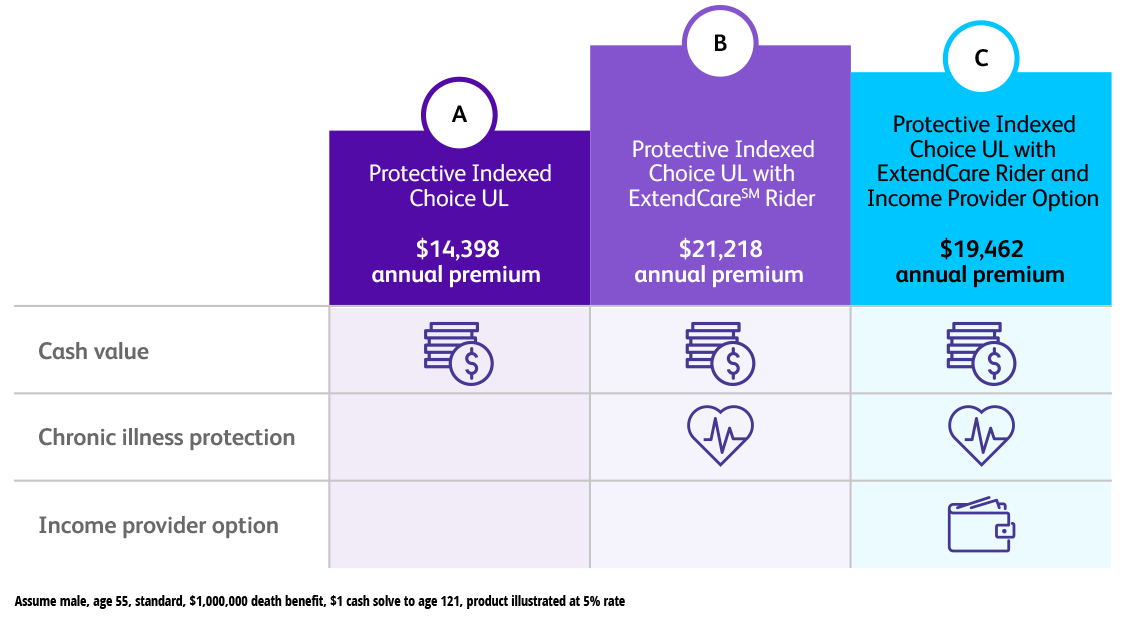

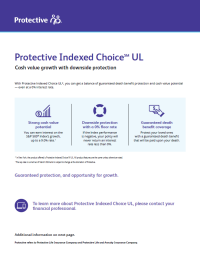

Review key product features and benefits

Give your clients an introduction to indexed universal life insurance

Show clients the benefits of adding chronic illness coverage to their IUL policy

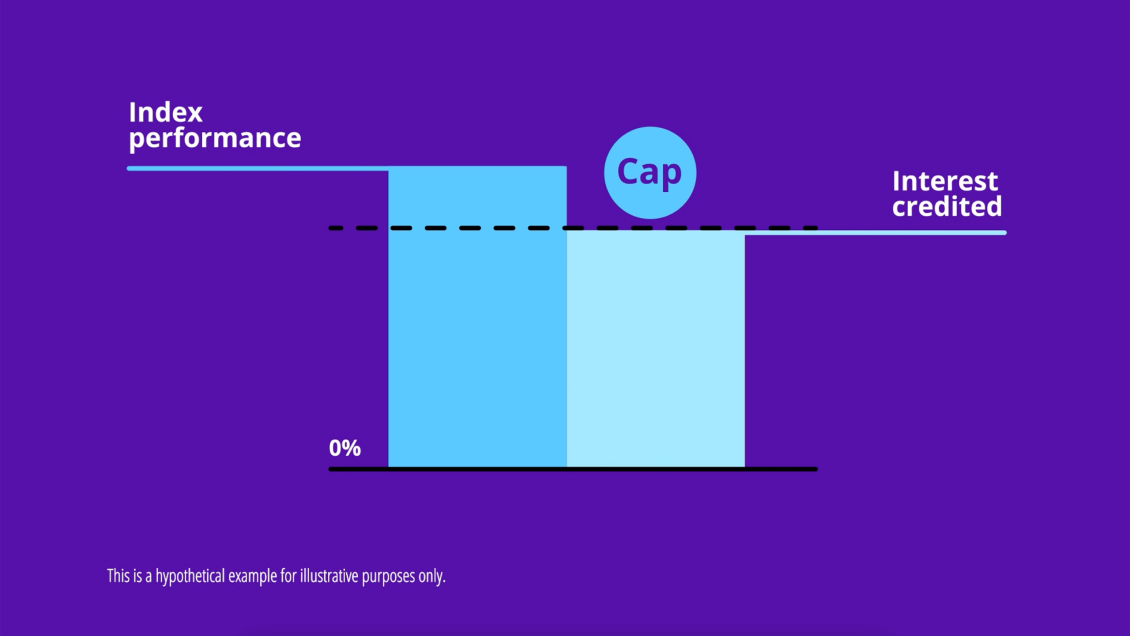

Explain how our IUL will never return a negative interest rate

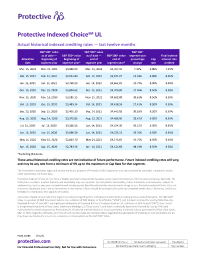

Review past index values and crediting rates

Other related topics

Protective Custom Choice%%SM%% UL offers affordable, flexible protection

Protective Advantage Choice%%SM%% UL for lifetime protection with options

Protective%%®%% Lifetime Assurance UL for affordable guarantees

We're here for you

Everyone deserves peace of mind when it comes to safeguarding what’s most important. We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

¹ In California maximum issue age is 75 for Tobacco.

WEB.3026459.01.23

WEB.3026459.01.23