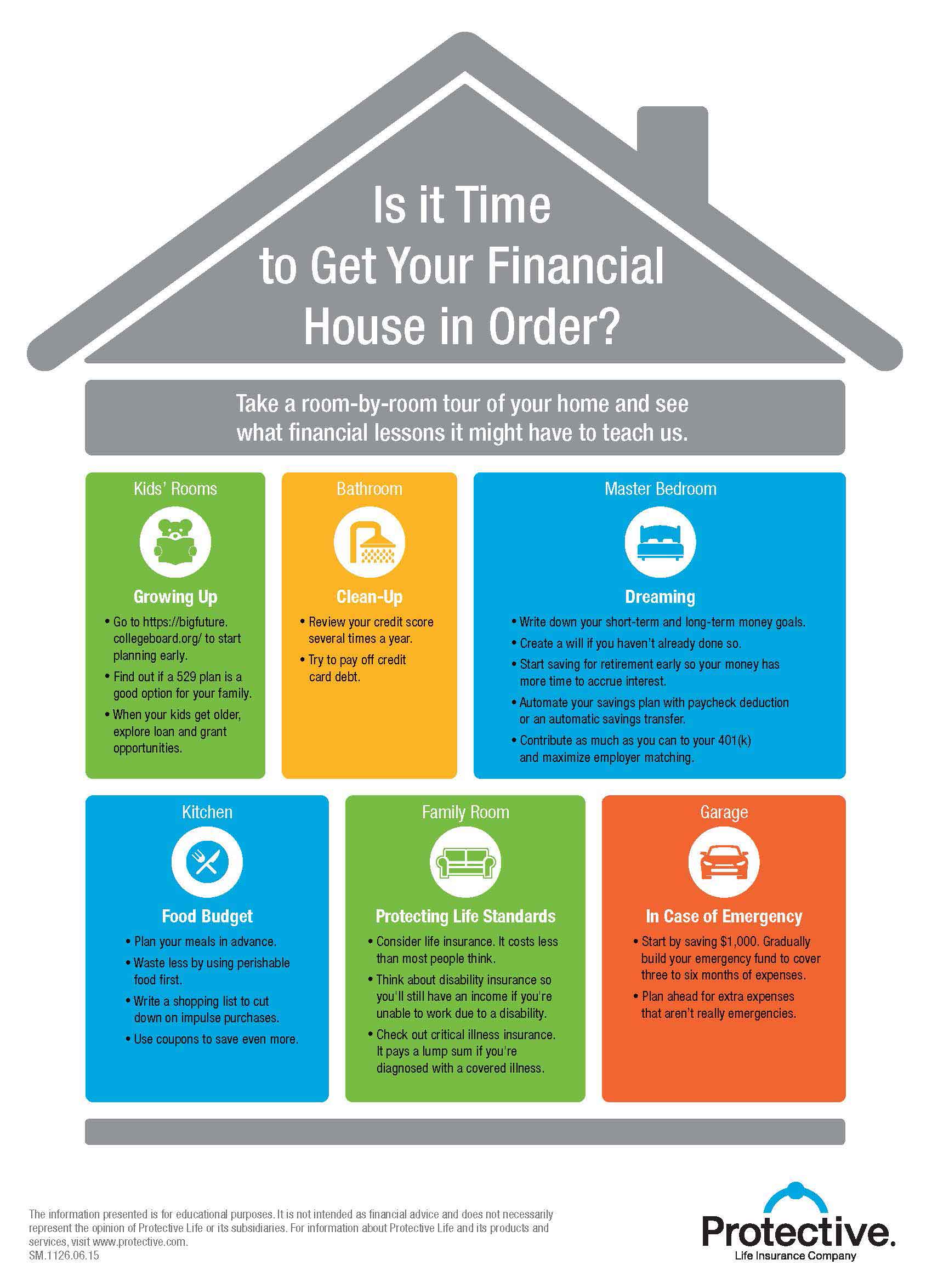

Let's face it - financial planning for most people is boring and complicated. But what if you took the same view of your finances as you do of your house? After all, each room of your house is dedicated to certain activities. You can use that analogy to help you tackle your bigger money picture one small area at a time. So let's take a tour of your home and see what each room has to teach us about remodeling our finances:

Your kitchen = food budget

What's the first thing you think about in the kitchen? Food, of course. And with a little advance planning, you can spend and waste less. Consider these kitchen improvement tips:

- Plan your meals in advance. Before shopping, take an inventory of what you already have and check your perishables. Create a shopping list to cut down on impulse purchases.

- Plan your meals with use-by dates in mind. Use the most perishable food first to avoid waste.

- Use coupons wisely. Don't buy things you don't need just because they're on sale.

The family room = protecting today's standard of living

Your family members matter most - have you protected them with life, disability and critical illness insurance? If so, have your policies been reviewed in the past year? Consider this:

- Life insurance is more affordable than most people think. You might be able to afford quite a bit just from cutting out your weekly latte on the way to work.

- Disability insurance secures your earning power, so if you're unable to work, you can sustain your lifestyle.

- Critical illness insurance pays a lump sum if you're diagnosed with a covered condition such as cancer.

Garage = tools to help fix and repair

Most of us have a toolkit in the garage to help with minor household repairs. But what if the roof gets a leak or you have an accident with the car? Make sure you're ready for financial emergencies:

- Keep emergency cash in a separate account that you aren't allowed to touch unless there's a true emergency.

- Plan ahead for extra expenses that aren't true emergencies - such as back-to-school or new tires. These types of expenditures should not be paid by the emergency fund.

- Start by saving $1,000 and then gradually build your emergency fund to cover three to six months of expenses. Repeat this process.

Kids' rooms = growing up

- Your kids will be ready for college in the blink of an eye. Have you started saving for college? Below are some resources to get you started. Go to bigfuture.collegeboard.org to estimate how much you need to save.

- Start saving early. Ask your financial advisor if a 529 plan is a good option for you.

- When your kids get older, explore loan and grant opportunities.

- Teach your children money management strategies before they fly the nest.

Bathroom = clean-up!

Make sure your credit history stays clean:

- Review your credit score several times a year.

- Pay off credit card debt.

Master bedroom = dream away

This is where you and your spouse dream about your future. Do you have a master financial plan to help you get there? Here are some ideas:

- Create short and long-term money goals. Consider an IRA account for additional savings.

- Contribute as much as you can to your 401(k) and take full advantage of any matching programs.

- Create a will if you haven't already done so.

- Start saving early so your money has more time to accrue interest.

- Automate your savings plan with paycheck deduction or an automatic savings transfer.

Now that we've completed the tour of your financial house, there's only one thing left to do: Get started with your home improvement plan! Protective is here to help.

To exercise your privacy choices,

To exercise your privacy choices,