Indexed universal life insurance

Indexed universal life insurance is for people who need lifetime protection, flexible features and potential cash value accumulation to help meet their financial needs for the future.

IUL could be the right policy for you if you want:

- Potential for lifetime death benefit coverage

- Cash value accumulation potential based on the performance of at least one market index (excluding dividends and subject to caps and floors)

- Flexible death benefits and premium payments

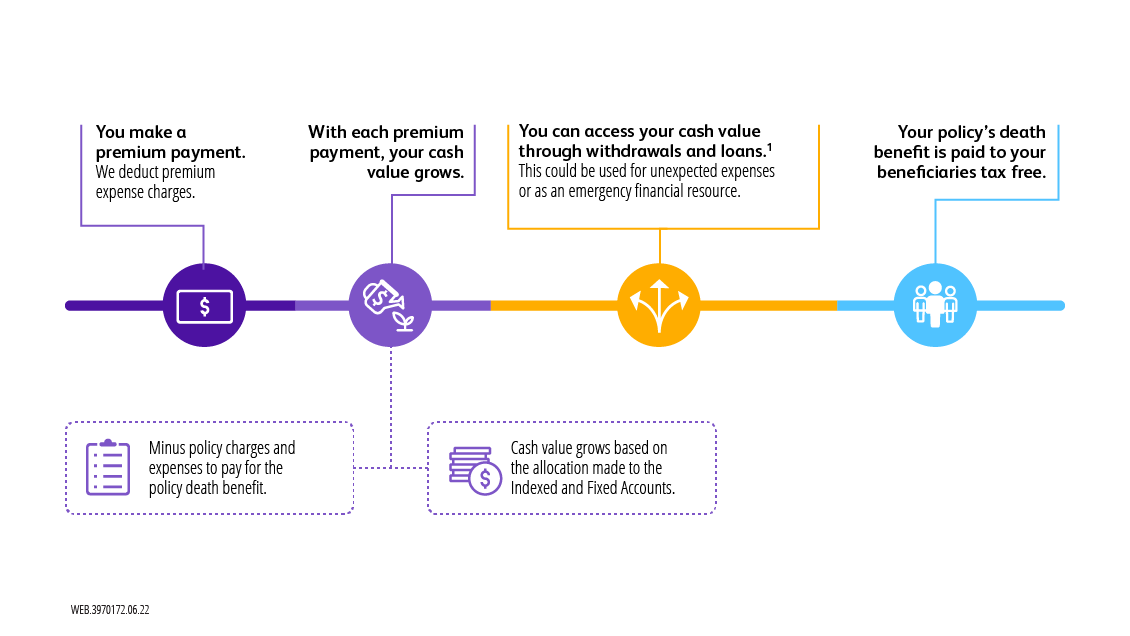

How does indexed universal life work?

You will have a choice of two interest accounts which work together to help you build cash value. For an IUL, the potential cash value accumulation is based on changes in one or more stock market indices, subject to caps and floors. When the market does well, so does your policy. Over the life of the policy, this could mean more cash value.

Choice 1 — Fixed Account

Any premium allocated to the Fixed Account earns interest at a specific rate.

Choice 2 — Indexed Account

The Indexed Account credits interest to your policy based on positive performance of a specific index, giving you a greater opportunity to build cash value, subject to caps and floors.

Resources for you

Find a solution to meet your needs

At Protective Life, we recognize that everyone has different financial needs. Whether you’re interested in indexed universal life insurance or another type of permanent* insurance, we offer a variety of life insurance policies from which to choose.

For more information, give us a call at 1-844-733-5433 and talk with a Protective Life Agent.

1 If a loan is taken out against the cash value, you must repay it or any outstanding loans will be deducted from the death benefit.

All payments and all guarantees are subject to the claims-paying ability of Protective Life Insurance Company. The tax treatment of life insurance is subject to change. Neither Protective Life nor its representatives offer legal or tax advice. Please consult with your legal or tax adviser regarding your individual situation before making any tax-related decisions.

An indexed universal life insurance policy is not an investment in an index, is not a security or stock market investment and does not participate in any stock or equity investments.

WEB.506561.05.20

To exercise your privacy choices,

To exercise your privacy choices,