Variable life insurance

Variable life insurance offers the lifetime protection of a permanent* life insurance policy with the potential to earn cash value based on the performance of your selected investment options. Call us at 1-844-733-5433.

*As long as required premium payments are timely made.

Find a policy that’s right for you

With variable universal life, a portion of your premium is allocated to the investment options offered through the policy, based on your risk tolerance and goals. The difference between variable universal life and other types of universal life is essentially the ability to choose investment options and the potential for cash value growth along with increased risk.

Variable universal life is often good for people who:

- Prefer the potential for higher returns and are comfortable with market risk.

- Like the flexibility of being able to move their cash value among investment options.

The benefits of variable life insurance

Is variable life insurance right for you?

Learn more

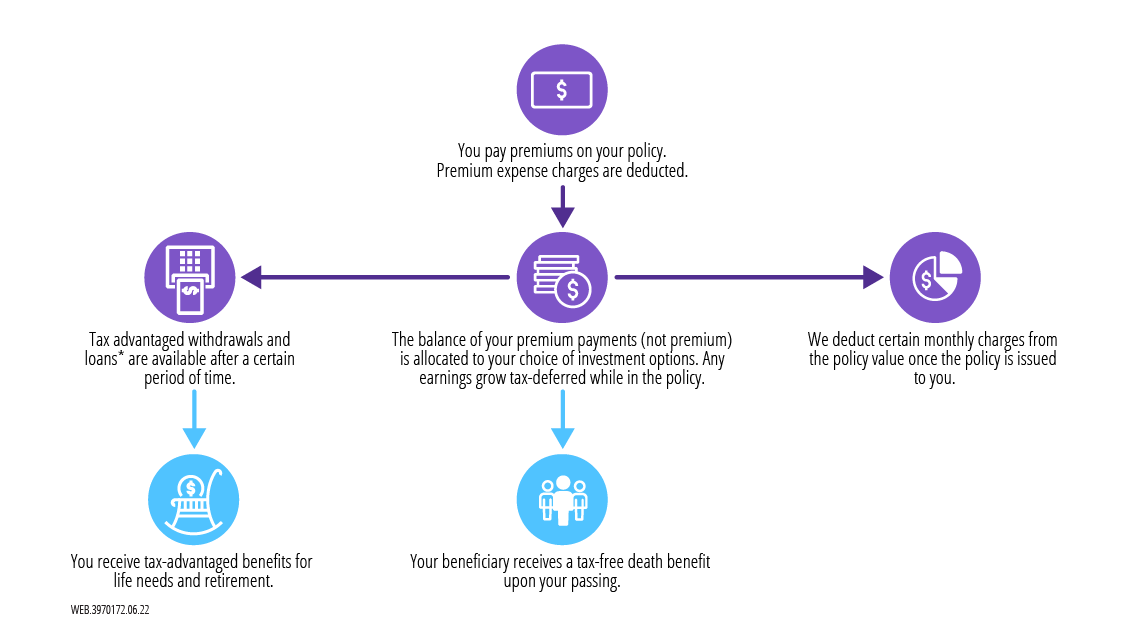

How does variable life insurance work?

Resources for you

If investments underperform (or if sufficient premiums are not paid), the policy may lapse or not accumulate sufficient value to maintain the policy. Investments in variable universal life insurance policies are subject to fees and charges from both the insurance company and the managers of underlying investments. You’ll find this and other information in the prospectuses for variable universal life insurance policies and their underlying investment options.

Investors should read the prospectuses carefully before investing. To understand Protective’s VUL options and read a prospectus, call us at 1-800-456-6330. VUL policies are considered securities contracts and are regulated by federal laws and must be sold with a prospectus.

Getting a life insurance quote with Protective Life is easy!

Find a solution to meet your needs

*Though interest is charged on loans, in general, loans are not taxable. Withdrawals are taxable to the extent they exceed basis in the policy. Loans outstanding at policy lapse or surrender before the insured's death will cause immediate taxation to the extent of gain in the policy. Unpaid loans and withdrawals reduce cash values and policy benefits. The tax treatment of life insurance is subject to change.

Variable universal life insurance policies issued by Protective Life Insurance Company (PLICO), Nashville, TN. Securities offered by Investment Distributors, Inc. (IDI), the principal underwriter for registered products issued by PLICO, its affiliate. IDI is located in Birmingham, AL.

Investors should carefully consider the investment objectives, risks, charges and expenses of the applicable variable universal life insurance policy and its underlying investment options before investing. This and other information is contained in the prospectuses for the applicable variable universal life insurance policy and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800.265.1545.

Neither Protective Life nor its representatives offer legal or tax advice. Purchasers should consult with their legal or tax advisor regarding their individual situations before making any tax-related decisions. All payments and all guarantees are subject to the claims-paying ability of Protective Life Insurance Company. The tax treatment of life insurance is subject to change.

WEB.1136.05.20