Protective Indexed Choice℠ UL

When you consider recommending an IUL to your clients, make sure you suggest a policy that fits within their budget and has a proven track record of consistency — even through industry disruption.

Protective Indexed Choice UL is still that same, great choice for clients and now offers lower premiums. It's designed to meet their unique needs, stacks up against other IULs in the marketplace, and performs as you and you clients expect.

When is our IUL most competitive?

Protective Indexed Choice UL plays especially well when your clients are looking for:

The straightforward, responsible design of Protective Indexed Choice UL balances growth, protection and risk — meaning you and your clients can rely on this IUL solution to deliver on what it promises. Here's how:

- Provides a guaranteed1 death benefit — Your clients will have support when it's needed most.

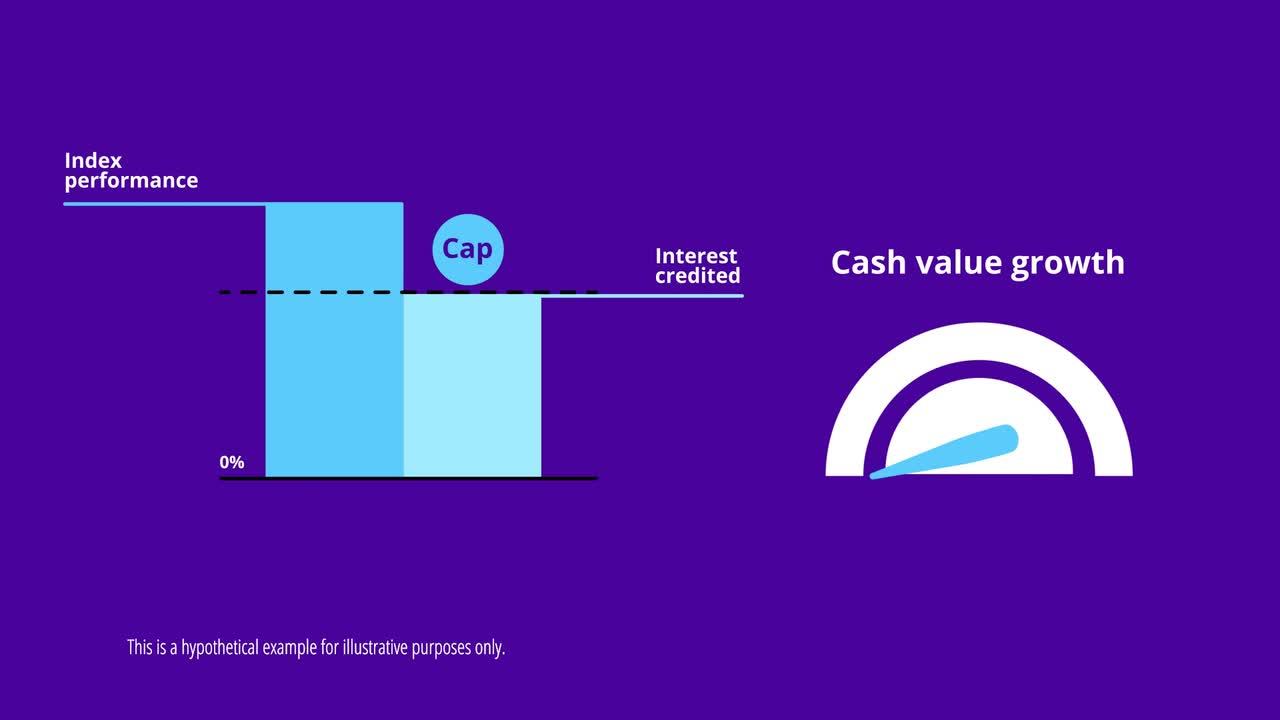

- Offers a realistic cash value projection — Your clients can be confident about their potential for cash value accumulation over the years.

- Designed with simplicity — Your clients can understand how their policy works before they sign the paperwork.

- Backed by a company that's financially strong — Your clients can rest assured that our product’s promises are dependable.

Want to see our IUL in action?

See how Protective Indexed Choice UL measures up against a market-leading IUL in this side-by-side comparison.

Solid protection solutions built for life

In addition to our competitive IUL solution, we have a portfolio of protection products that can help you address different types of life insurance needs, so you can better serve your clients.

For Financial Professional and Plan Sponsor Use Only. Not for Use With Consumers.

*Availability may vary by state.

1 As long as the premiums are paid as illustrated and no loans are taken on the policy, the death benefit is guaranteed to remain in force for the period illustrated.

Protective is a registered trademark of Protective Life Insurance Company and Indexed Choice is a trademark of Protective Life Insurance Company.

Protective Indexed ChoiceSM UL (UL-27) is a flexible premium universal life insurance policy issued by Protective Life Insurance Company, Nashville, TN. Policy form numbers, product features and availability may vary by state. Consult policies for benefits, riders, limitations and exclusions. Subject to underwriting. Up to a two-year contestable and suicide period. Benefits adjusted for misstatements of age or sex. In Montana, unisex rates apply.

Protective Indexed Choice UL is not a security investment and is not an investment in the market. Your insurance professional can provide you with costs and complete details about the terms, conditions, limitations or exclusions that apply to this policy.

The tax treatment of life insurance is subject to change. Neither Protective Life nor its representatives offer legal or tax advice.

Please consult with your legal or tax advisor regarding your individual situation before making any tax-related decisions.

All payments and all guarantees are subject to the claims-paying ability of Protective Life Insurance Company.

To exercise your privacy choices,

To exercise your privacy choices,